I love to watch TV. I’ve recently enjoyed binge watching “Wednesday” on Netflix and I’m looking forward to the February release of the final season of “Wu-Tang: An American Saga,” the March release of “Succession,” and eagerly (but sadly) looking forward to watching the sixth and final season of "Cobra Kai" sometime this year.

Over the past year, I’ve found watching the vendor landscape surprisingly entertaining as well. With frequent plot twists announced via press release, a rotating cast of tech stars, and new media darlings taking center stage—vendors are serving up the excitement. Our collective interest in the solutions market even compelled Citisoft to dedicate our entire Outlook 2023 to discussing the vendor trends that are driving change in outsourcing, technology, operating models, and talent.

At Citisoft, we try and stay on top of what is happening with vendors and find that right now, most are coming up with some new and exciting offerings and many have impressive initiatives in progress, the outcomes of which will dictate how closely the industry watches these specific vendors in the future. Without further ado, I have chosen three vendors that are in the midst of big initiatives that we are looking forward to watching in the coming year.

FundGuard is a newish player on the accounting scene—both IBOR and ABOR capable. Few people in the industry would claim that accounting is a glamorous and exciting domain, but the difference here is that cloud-native accounting technology has not been at the forefront historically. FundGuard has a deep bench of accounting system expertise and has recently made some key hires of alumni from their competitors. Late last year, FundGuard announced partnerships with two large custodian bank service providers: one to be the IBOR/investment accounting engine and the other to be the ABOR/fund accounting engine. Replacing the core accounting platform within a service provider’s architecture is no easy task and a success story (or two) here will go a long way for wider FundGuard interest and adoption.

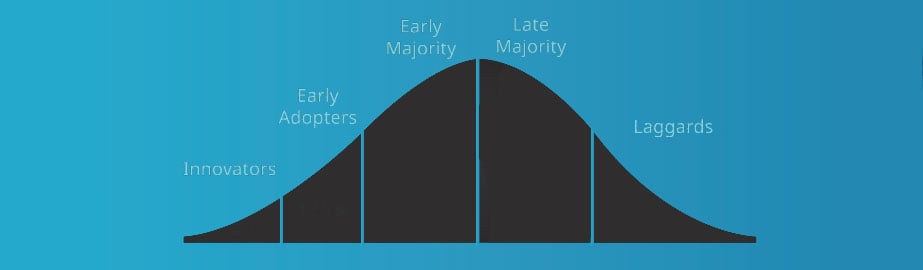

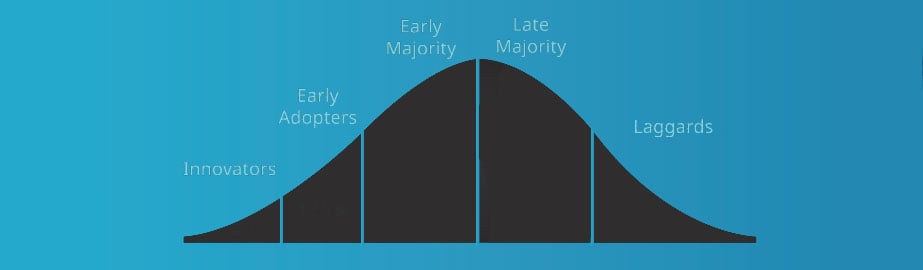

State Street Alpha is in the midst of onboarding some very large (and some not-as-large) asset managers. In the news, you have seen them announce some members of the “Trillion Dollar Club,” which will require multi-year efforts to fully transition. While some firms start simple and small and build up to coverage for larger clients with more complex requirements, State Street is taking the opposing approach. I’m speculating that the thought here is that between these larger clients, most scenarios and requirements will be covered so if they can support the big guys, they can support the wider asset management market. For some firms, the sentiment around being an early adopter is met with skepticism and there is reticence to jump right in before a solution is proven. The industry is watching these early adopters as they partner with State Street and work to prove out the front-to-back Alpha model.

SS&C has a long history of acquiring proven, well-adopted software to add to their line up but recently they have focused on development of a few new offerings. For example, in the past few years, they have added Singularity which has been prevalent in many insurance accounting replacement evaluations and are also marketing a holistic, single data model offering called Aloha. We’ve been hearing about Aloha for some time now and are eager to learn more about them as a front-to-back player through our client engagements in 2023.

All this said, I would be remiss not to promote proper due diligence in any vendor or service provider decision. While success with implementation and transitions can be reassuring, it may not be indicative of success for all firms. Whether you want to be a pioneer or want to take a wait and see approach, the importance of proper solution evaluation, due diligence, and operating model planning cannot be overstated when selecting a new vendor or services partner. There are many exciting initiatives not covered here and we wish all firms and vendors undergoing transformative initiatives this year lots of success. I look forward to watching the vendor landscape continue to evolve in 2023!

Comments